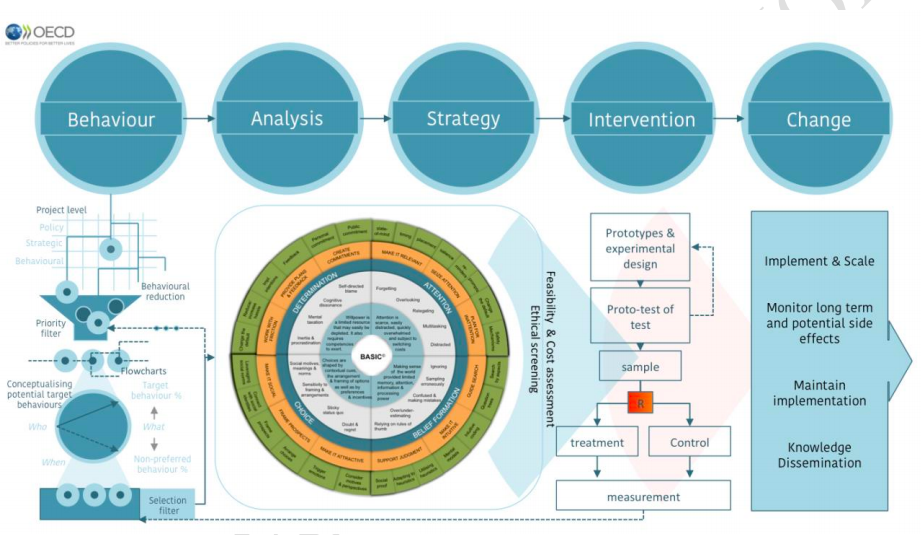

BEHAVIORAL INSIGHTS. BASIC TOOLKIT AND ETHICAL GUIDELINES FOR POLICY MAKERS

This OECD report is really helpful. It tries to provide a concret approach to behavioral insights for policy makers. It goes beyond standard nudging perspective.

25 de juny 2019

24 de juny 2019

Making healthcare more human

Eric Topol on making healthcare more human

A weekly conversation that looks at the way technology is changing our economies, societies and daily lives. Hosted by John Thornhill, innovation editor at the Financial Times.

20 de juny 2019

Pharma outlook

World Preview 2019,Outlook to 2024

If worldwide Total Prescription Drug Sales (2010-2024) increase 6,9% every year between 2019 to 2024 than somebody has to tell me the source to achieve such resources. This is the estimate of a report. I know, the report says worldwide, but it seems an expected revenue that it is really out of any budget, public and private. We'll see.

If worldwide Total Prescription Drug Sales (2010-2024) increase 6,9% every year between 2019 to 2024 than somebody has to tell me the source to achieve such resources. This is the estimate of a report. I know, the report says worldwide, but it seems an expected revenue that it is really out of any budget, public and private. We'll see.

Prescription drug sales for 2010 through 2018 grew at a CAGR of +2.3%. This can be compared to the forecast annual CAGR of +6.9% for 2019 through 2024 with expected sales to reach $1.18trn. The growth rate for the prescription market in 2019 is forecast to be +2.0%, which depicts a decline in growth rate compared to 2018 (+5.0%). So far the industry has seen a major set-back with one of the biggest failures, aducanumab, which was discontinued in Phase 3 trials for Alzheimer’s disease.Distrust fortune tellers. Nobody knows anything about the future.

19 de juny 2019

18 de juny 2019

Resource allocation for universal coverage in healthcare

Price setting and price regulation in health care: Lessons for advancing Universal

Health Coverage

Once upon a time Joseph Newhouse said that there are no prices in healthcare. There are some forms of administered prices, tariffs and payment systems. Unfortunately current health economists forget to read some books like "Pricing the priceless", a must read.

Now a new report by WHO and OECD insists again on prices and says:

Health Coverage

Once upon a time Joseph Newhouse said that there are no prices in healthcare. There are some forms of administered prices, tariffs and payment systems. Unfortunately current health economists forget to read some books like "Pricing the priceless", a must read.

Now a new report by WHO and OECD insists again on prices and says:

Pricing health services is a key component in purchasing the benefits package (the covered services) within the overall financing system (Evetovits, 2019). Pricing and payment methods are important instruments in purchasing that provide incentives for health care providers to deliver quality care. A second instrument is contracting, in which the conditions for the payment of services are defined, and prices can be used as signals to providers. A third is performance monitoring. Where health care providers are rewarded based on the outcomes they achieve, these payments also must be priced correctly to provide the right incentives.Right, there are more elements in the equation than prices, but the tools for fine tunning are too open. Anyway, this report is really welcome and the cases are well described.

15 de juny 2019

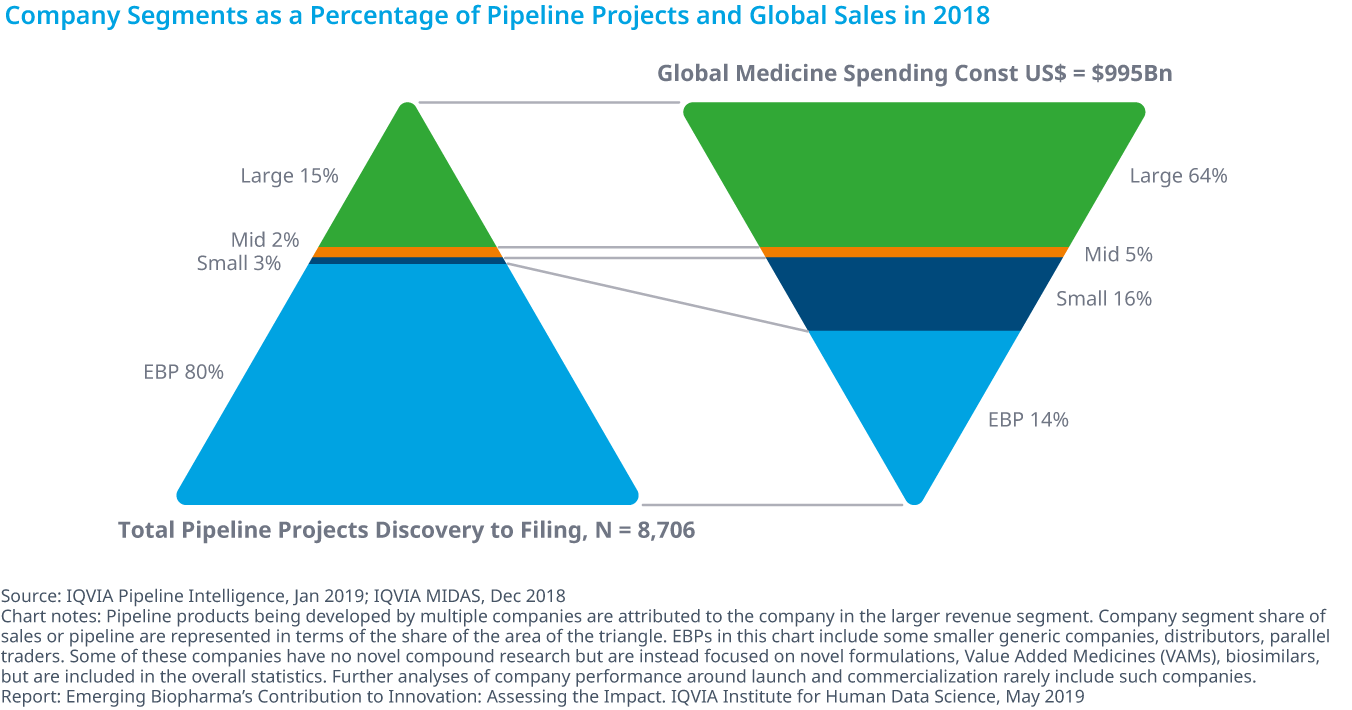

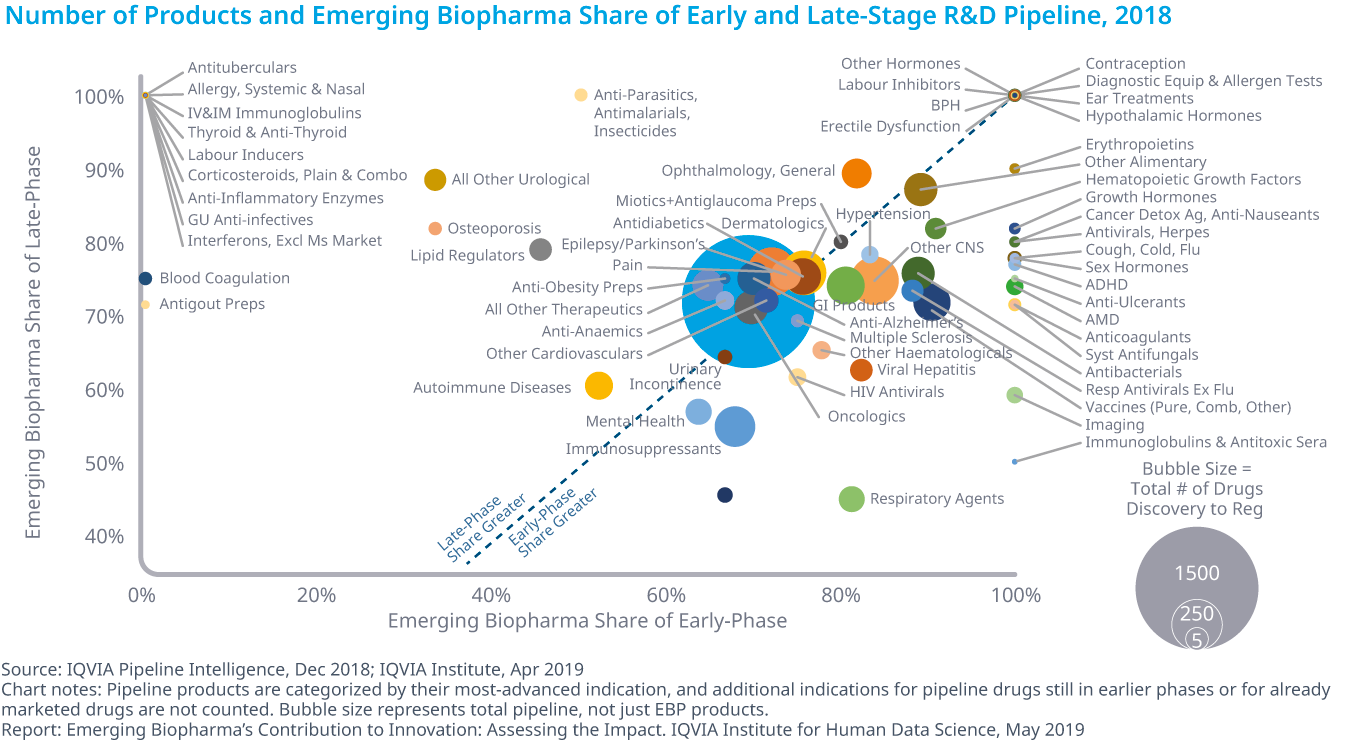

Who is in charge of Pharma R&D?

Emerging Biopharma’s Contribution to Innovation

From the report:

From the report:

- Emerging biopharma companies accounted for 73% of the total late-stage R&D pipeline in 2018, compared with 61% in 2008.

- Large pharma companies have seen their share drop from 27% to 19% from 2017 to 2018.

- The share of mid-sized and small pharma companies developing novel products has remained steady since 2003, with small pharma developing approximately 5–6% of products and mid-sized pharma developing from 2–5%.

- Emerging biopharma companies are increasing their pipeline share, because they are the most active in the fastest-growing areas of oncology and orphan drugs, and because they increasingly can develop their innovations without the need to partner or be acquired.

14 de juny 2019

The productivity and outcome of oncology pipeline

Global Oncology Trends 2019

IQVIA has released a report on current state of oncology treatments.

PS. Cancer drugs report 2018, Libro blanco terapia celular

IQVIA has released a report on current state of oncology treatments.

The 2018 launch of 15 new active substances (NASs) bring the total NAS launches since 2013 to 57 with 89 approved indications for 23 different tumor types Within the R&D oncologic pipeline, the most intense activity is for immunotherapies, with almost 450 in clinical development A total of 1,170 oncology clinical trials were initiated in 2018, an increase of 27 percent from 2017 and 68 percent from 2013 More than 700 companies across the globe have oncology drugs in late-stage development, including 626 emerging biopharma companies and 28 out of the 33 largest pharma companiesOn costs in USA:

The average annual cost of new medicines continues to trend upward, although the median cost dropped $13,000 in 2018 to $149,000, and cost per product ranged betweenOn value?

$90,000 and over $300,000. The mean cost for new brands in 2018 was $175,578, down from $209,406 in 2017, but was above the $143,574 mean from 2012 to 2018.

Spending on cancer medicines is heavily concentrated, with the top 38 drugs accounting for 80% of total spending. Over half of cancer drugs earn more than $143.6 million in annual sales and in aggregate account for only 2.2% of oncology spending.

PS. Cancer drugs report 2018, Libro blanco terapia celular

Subscriure's a:

Missatges (Atom)