The high degree of persistence in membership in the extremes of the residual spending distribution in all three countries raises concerns that insurers might take steps to deter those who tend to be underpaid and attract those who tend to be overpaid. Attracting the healthy/deterring the sick among subsets of the populations with the disease indicators (such as diabetes) prevalent on both extremes of the residual spending distribution could be a highly profitable strategy, and potentially lead to distortions in the efficient care for these groups. In response to these findings, we proposed a form of reinsurance, based on residuals, and targeted to members of a “risk pool” defined on past-year very high undercompensation. Careful targeting (along with re-estimating the beta weights in risk adjustment to take into account the reinsurance payments) leads to very substantial improvements in overall fit of payments to spending, with especially large effects for the most extremely under- and overcompensated. The share of people affected by this form of risk sharing is very small, less than 3 in 1000 in all three countries. While our proposed policy seems effective in better tying payments to spending, there are alternative approaches to the same issue. One example would be to find ways to split groups like those with diabetes and other illnesses prevalent among the undercompensated into those likely to be on one or the other side of the residual spending distribution. Calling attention to the powerful effects members of the tails of the residual distribution have on the overall fit of the models is the first step in directing policy attention to these important groups.

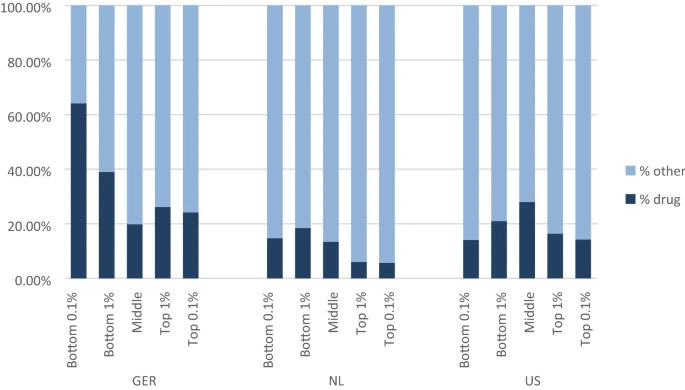

Share of spending on drugs by residual spending groups